Mynt – Fintech Venture From Globe Telecom

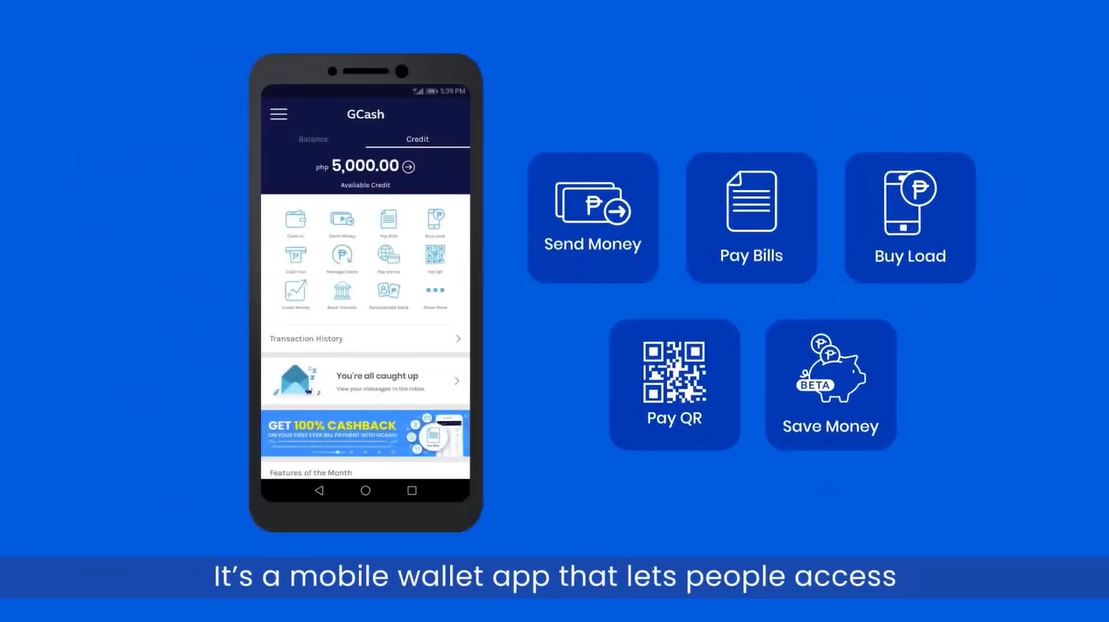

If you haven’t heard of MYNT Filipino Globe Techasia yet, you’re not alone. This fintech venture is also the owner of the mobile wallet GCash, which is part of Globe Telecom Inc. Mynt is backed by investors like Bow Wave Capital Management, a New York-based investment firm. The company is headquartered in Manila, and aims to bring financial technology to the Philippine market.

Also Read: warriors of aradena

Mynt

MYNT Filipino Globe Techasia is a fintech startup based in the Philippines that has recently raised over $300 million in funding from global investors. Its latest funding round was led by Warburg Pincus, and it has also received backing from Globe Telecom, Ayala Capital, and the Ant Group. The company has 48 million active users, and its gross transaction value is around PHP 2.8 trillion.

Mynt is a fintech company that offers mobile money, payments, and business solutions for consumers in the Philippines. It is also a network partner of Remitly, an American financial services company. This allows customers to send money and pay for purchases through a simple, secure mobile app.

The company also offers credit products to its users and banking partners through its own platform. It claims the lowest non-performing and past-due loan rates in the region. It also recently piloted a cash loan product, GLoan, which allows users to spread their repayment over 12 months. The company also plans to introduce “Buy Now, Pay Later” products within the next year.

Chinese tech giants have been pouring money into the Philippines in order to compete with PLDT. The Chinese tech giants recently invested in Mynt and purchased stakes in Rocket Internet and GLoan, which are both fintech startups in the Philippines. The company plans to use the new funding to expand its mobile loan and micropayment services.

GLoan

MYNT Filipino Globe Techasia is the mobile payments and credit service company owned by Globe Telecom. The company has raised over $300 million in funding to date, valuing it at over $2 billion. The round was led by Warburg Pincus and Insight Partners, and included additional capital from Globe Telecom.

Mynt’s mission is to help Filipinos gain access to financial services through technology. Its services include payments, remitts, and loans, and is a key part of the country’s push for financial inclusion. It expects to double its valuation by 2022.

Mynt is backed by Chinese investor Ant Group and has raised over $300 million from global investors. It has been valued at over $2 billion, and is now a unicorn in its home country. Other international investors include Warburg Pincus, Insight Partners, and Ayala Capital.

Mynt has been a major player in the payments industry since it launched in the Philippines in 2015. The company has grown to be the leader in its home country and claims that nearly half the population uses its services. It has disbursed over $3.2 billion in transactions to date, and claims peak app log-ins of over 12 million. The company has recently raised $300 million in funding, and recently announced that it plans to launch a local version of its platform.

GLoan pilot

MYNT Filipino Globe Techasia is a leader in digital payments in the Philippines, delivering digital financial services to more than 48 million users – more than half the country’s population. The platform has grown to become the “go to” payment and financial services solution in the country, with peak daily app log-ins of 19 million and 12 million active transactions per day.

The company has been backed by global investors such as Warburg Pincus, Insight Partners, and Globe Telecom. It is valued at over $2 billion. It has partnered with a number of companies in the Philippines, including Globe, Ayala, and Globe. The company says it has more than 48 million users and is on track to reach PHP 3 trillion in gross transaction value.

Mynt offers a full range of financial services, from savings to credit and insurance. Its subsidiary GCredit disburses over a billion dollars in loans each month. It also boasts of having one of the lowest past-due and non-performing loans in the country. Recently, it has piloted a cash loan product called GLoan. This product enables customers to spread their payments over twelve months, allowing them to pay off their loans as they wish. The company also plans to offer a “Buy Now, Pay Later” product.

Strategy

MYNT Filipino Globe Techasia, a fintech company headquartered in Manila, hopes to double its valuation in the coming years, from $1 billion to $2 billion. The company is backed by the Ant Group and has gained global recognition through its popular GCash mobile app. The company recently closed a $175 million funding round and has added 11 million users. The Philippines is one of the most promising growth markets for fintech, but it is also facing tough competition from traditional banks and other digital challengers.

In its newest move, Mynt has restructured its strategy to become a more sustainable company. It has also hired a new CEO, Martha Sazon, who was previously with Globe. The move is part of a string of top leadership changes. In the Philippines, it has also invested in a fintech startup, Voyager, which operates GCash rival Paymaya. Voyager also runs a payment gateway and merchant acquiring business.

The company’s initial funding round was delayed. But it has since begun reducing staff for its overseas e-wallet investments. As a result, Ant’s focus is now on Mynt, which may benefit from this new focus. In fact, Mynt is considered Ant’s most promising Southeast Asia venture. But unlike Ant, Globe has more local expertise and is a more prudent company.

In the Philippines, MYNT Filipino Globe Techasia is the owner of the leading e-wallet, GCash. The company’s recent investment round led by Warburg Pincus and Insight Partners, with participation from existing investors Globe and Ayala. Today, the company is valued at more than $2 billion and is considered one of the leading fintech firms in the region. If you want to get latest information just follow us https://cryptohike.in/

Relevant Post:

BRIEF INTRODUCTION OF CUMROCKET CRYPTO CURRENCY & WEBULL CRYPTO CURRENCY !

HOW DOES CRYPTO HASBULLA WORK?

HOW TO BUY CRUNCHYROLL PREMIUM ACCOUNT WITH CRYPTO ?

REVIEW: CRYPTO RICH DELUXE TRADING CARDS